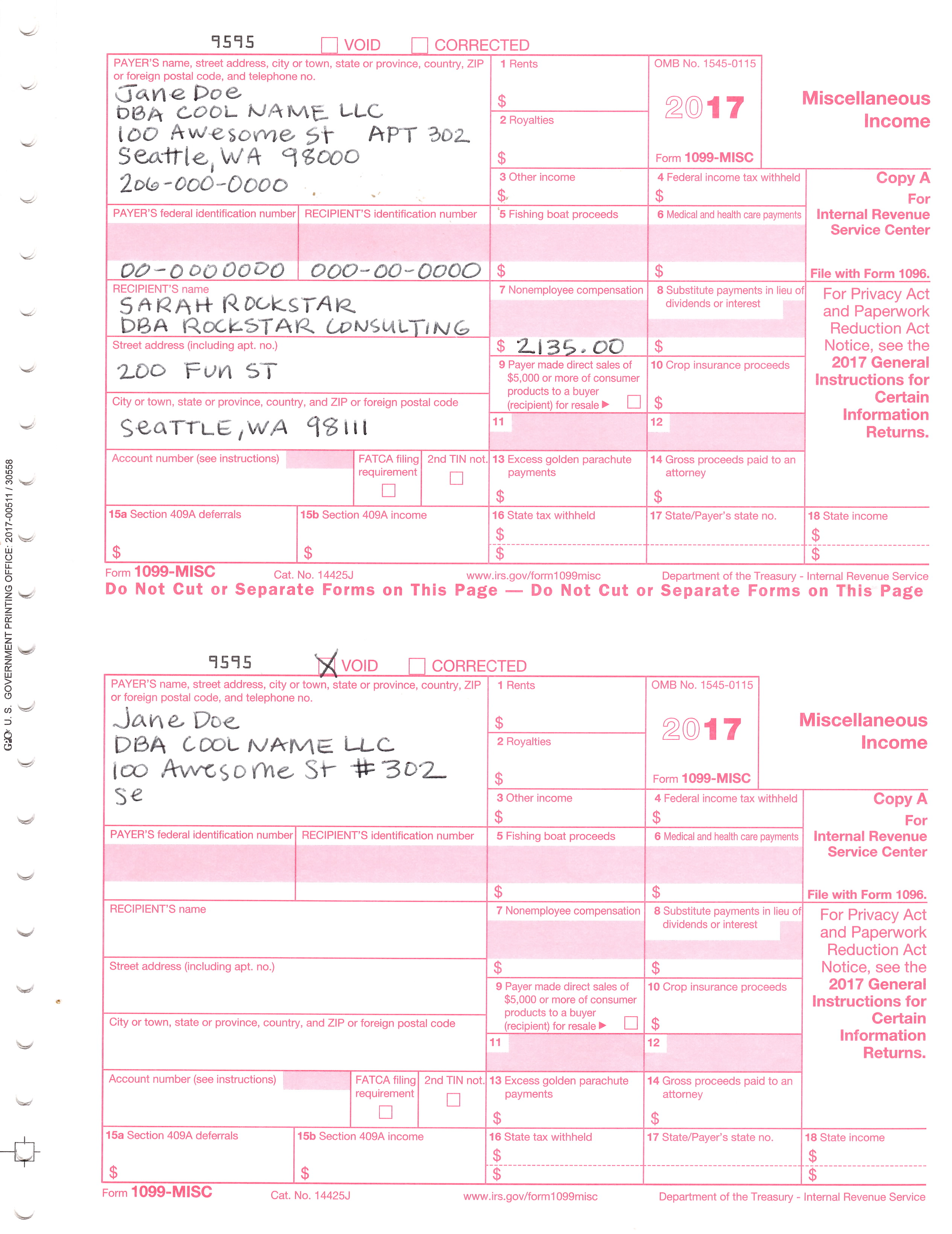

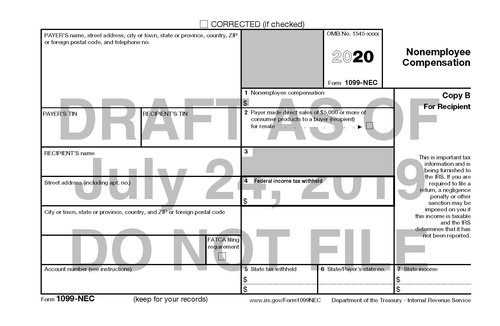

1099 Sample Forms This appendix includes the following sample forms Appendix H, "1099 Miscellaneous Income (Updated for 1099)" Appendix H, "1099 Nonemployee Compensation" Appendix H, "1099 Dividends and Distributions (Updated for 1099)" Appendix H, "1099 Interest Income" These forms are for informational purposes only11/3/ · Also file Form 1099MISC for each person you withheld federal income tax from under the backup withholding rules (regardless of the payment amount) As of tax year , do not use Form 1099MISC to report contractor payments This is where Form 1099NEC comes in And as always, don't use a 1099 for W2 employees1/27/ · Stepbystep instructions for filing Form 1099MISC for the tax year Updated on January 27, 1030 AM by Admin, ExpressEfile The IRS recently updated Form 1099MISCFor , this form no longer supports reporting for nonemployee compensation, but businesses still need to file it to report miscellaneous payments

Irs Form 1099 Reporting For Small Business Owners In

1099 misc example 2020

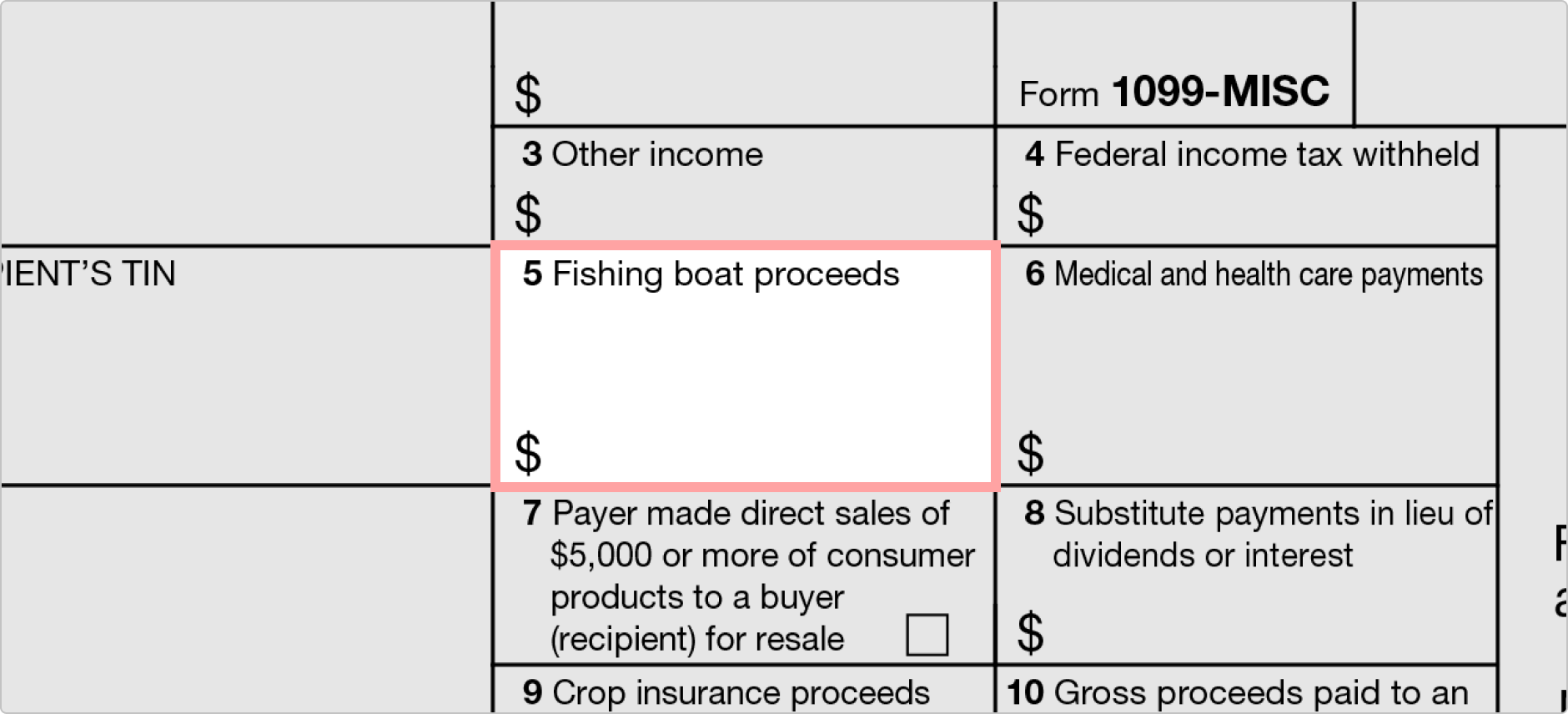

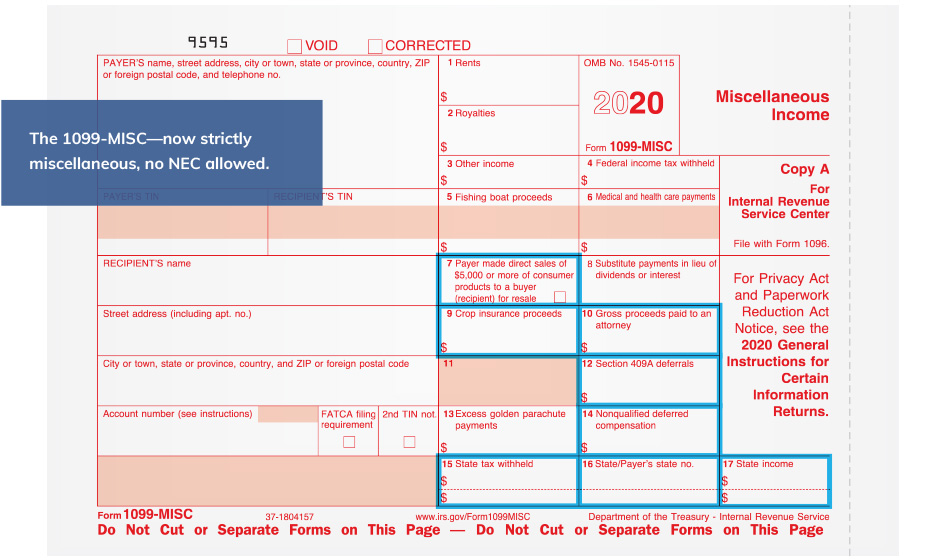

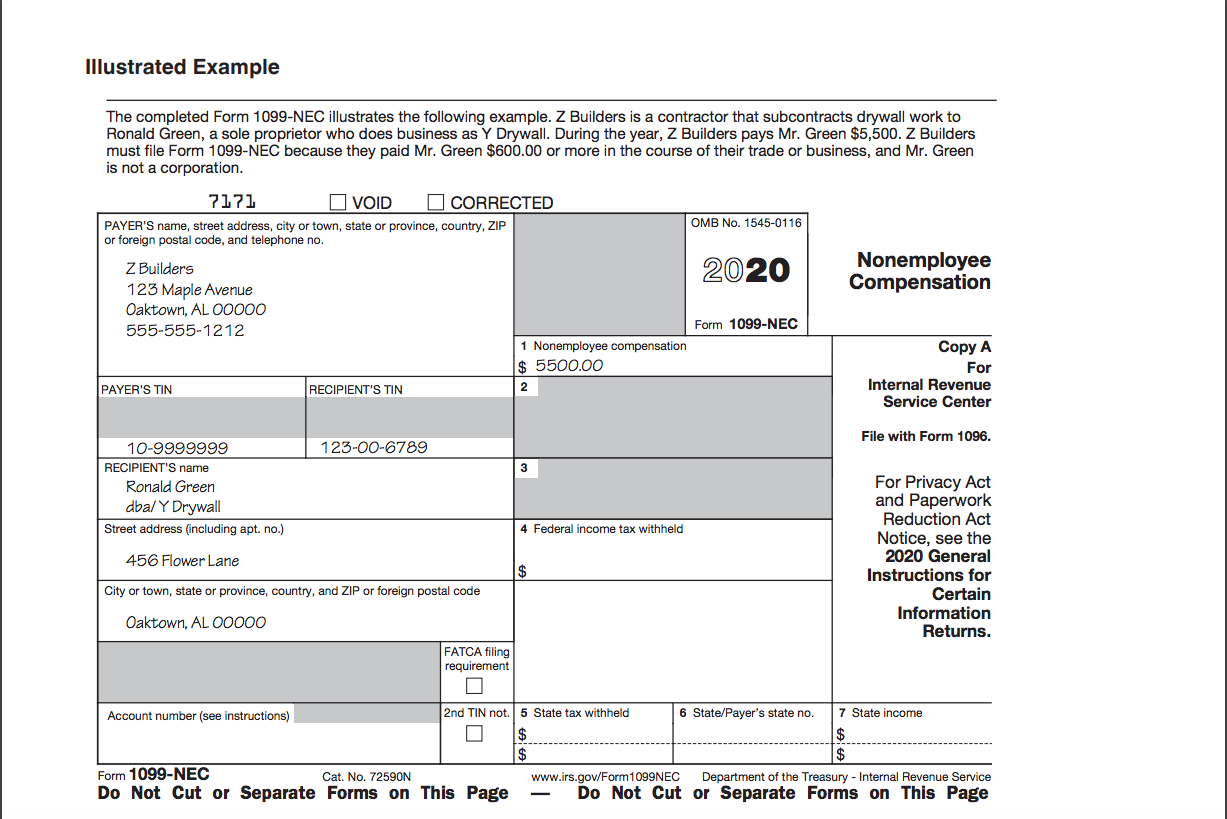

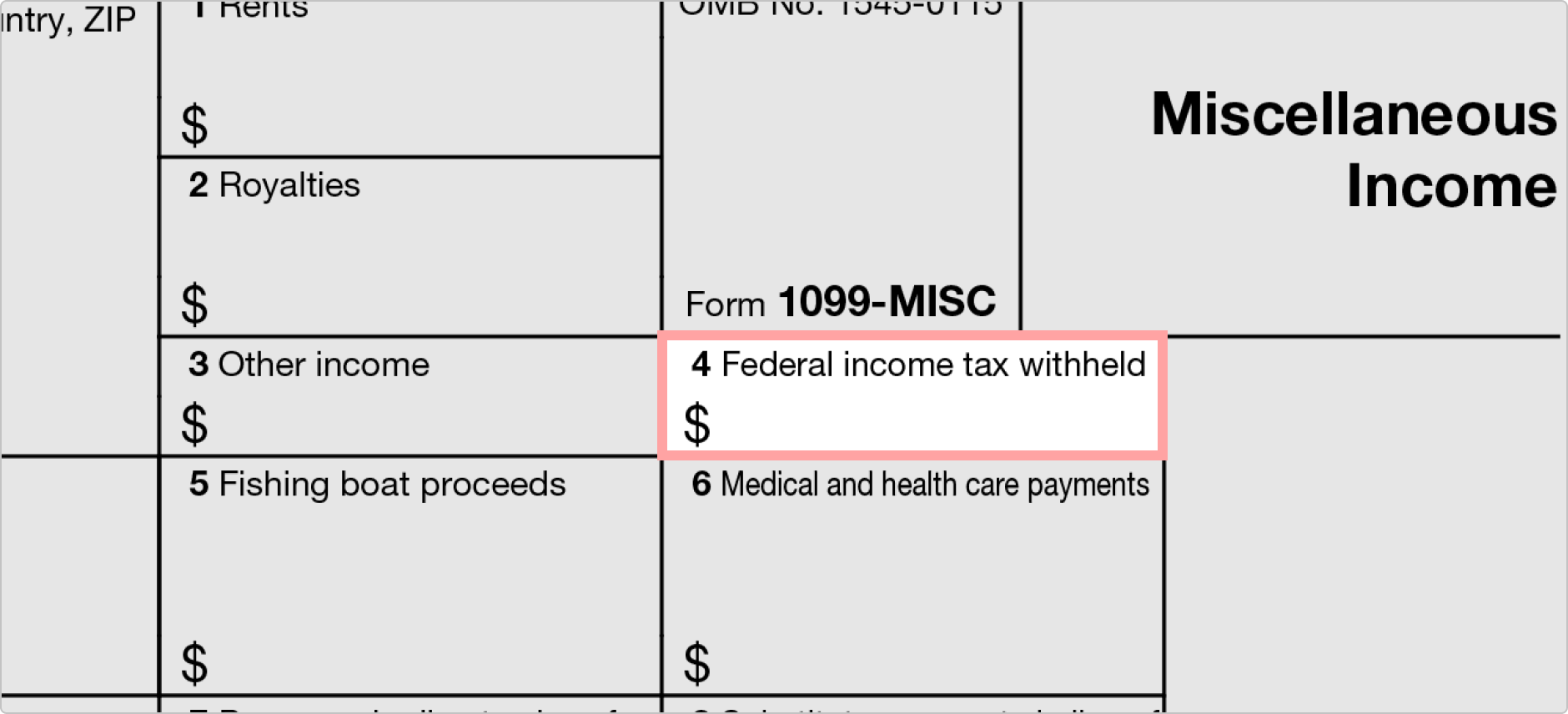

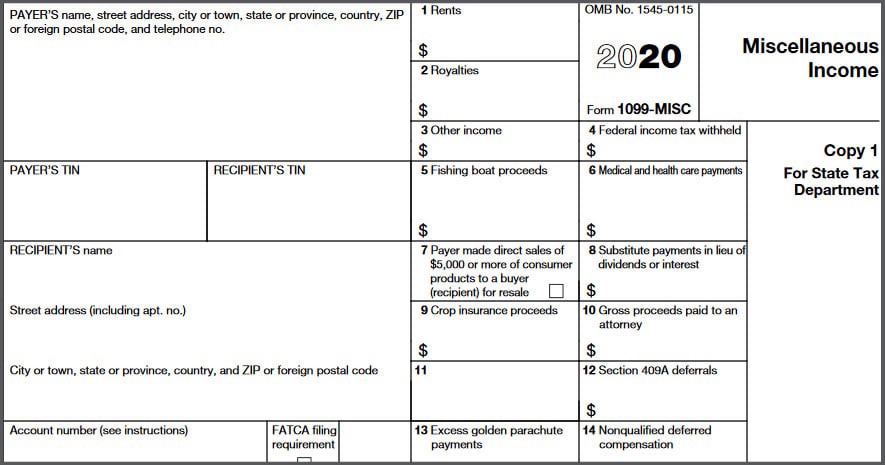

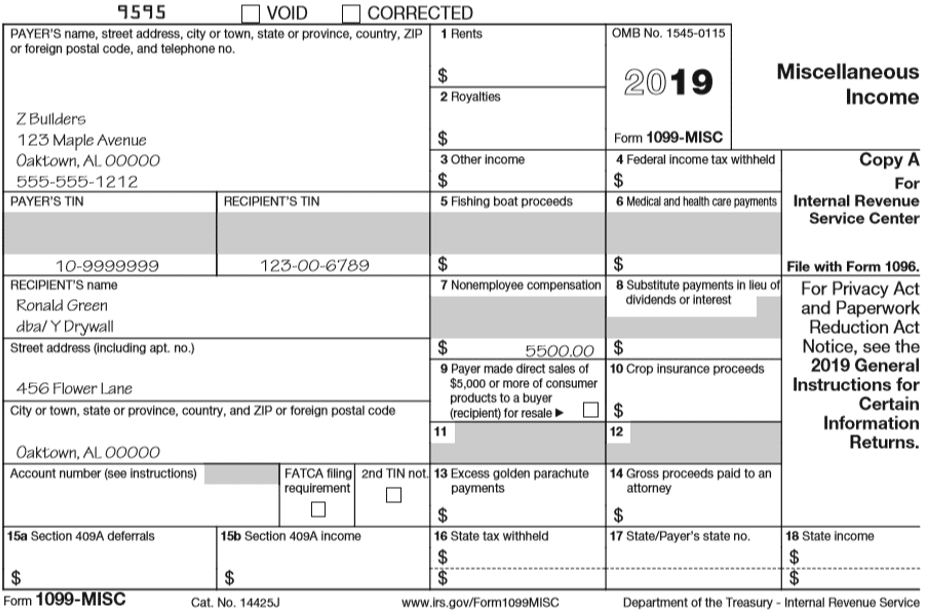

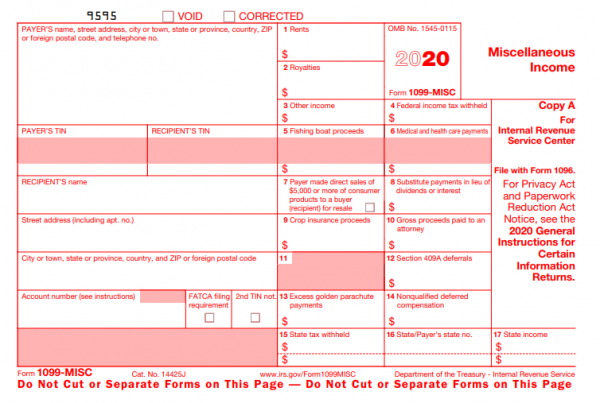

1099 misc example 2020-Redesigned Form 1099MISC Due to the creation of Form 1099NEC, we have revised Form 1099MISC and rearranged box numbers for reporting certain income Changes in the reporting of income and the form's box numbers are listed below • Payer made direct sales of $5,000 or more (checkbox) in box 7 • Crop insurance proceeds are reported in box 9How to File 1099MISC // Tax for Photographers

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

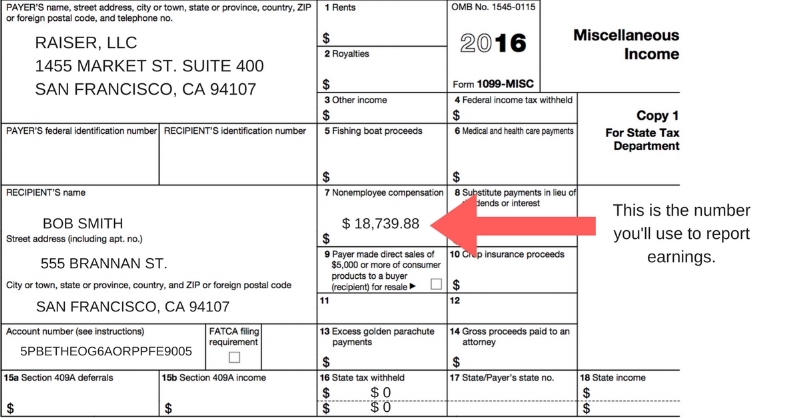

Form 1099MISC is used to report miscellaneous compensation such as rents, prizes and awards, medical and healthcare payments, and payments to an attorney UntilIf your business has made miscellaneous payments amounting to at least $600 or more, then you must report such payments to the IRS by filing Form 1099MISC 1099MISC Due Date 21 and Important Dates The IRS has recently announced that all 1099 forms must be filed on or by the 31st of January 211/31/ · You can enter a 1099MISC on the 1099MISC Summary screen Open or continue your return Search for 1099misc Select the option to go to the 1099MISC section Select Yes to Did you get a 1099MISC?

3/18/21 · Common Types of 1099 Forms The type of 1099 form that you will use will depend on the type of income that you received Here are seven common types of 1099 forms below Form 1099MISC Form 1099MISC is for miscellaneous income This could be from work you did as a freelancer, independent contractor or intern6/19/18 · Get IRS 1099MISC 21 Follow this guideline to quickly and correctly complete IRS 1099MISC How to complete the IRS 1099MISC online For example, if you earn $15,000 from working as a 1099 contractor and you file as a single, nonmarried individual, you should expect to put aside 3035% of your income for taxesForm 1099NEC Nonemployee Compensation Copy B For Recipient Department of the Treasury Internal Revenue Service reported on Form 1099MISC for additional tax calculation See the Sample Company 1456 SW Drive Chicago, IL SMITH M HAYES Line 2 Name 142 Happy Dr

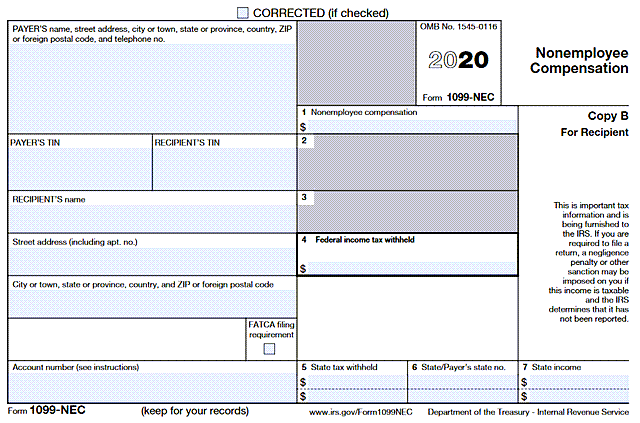

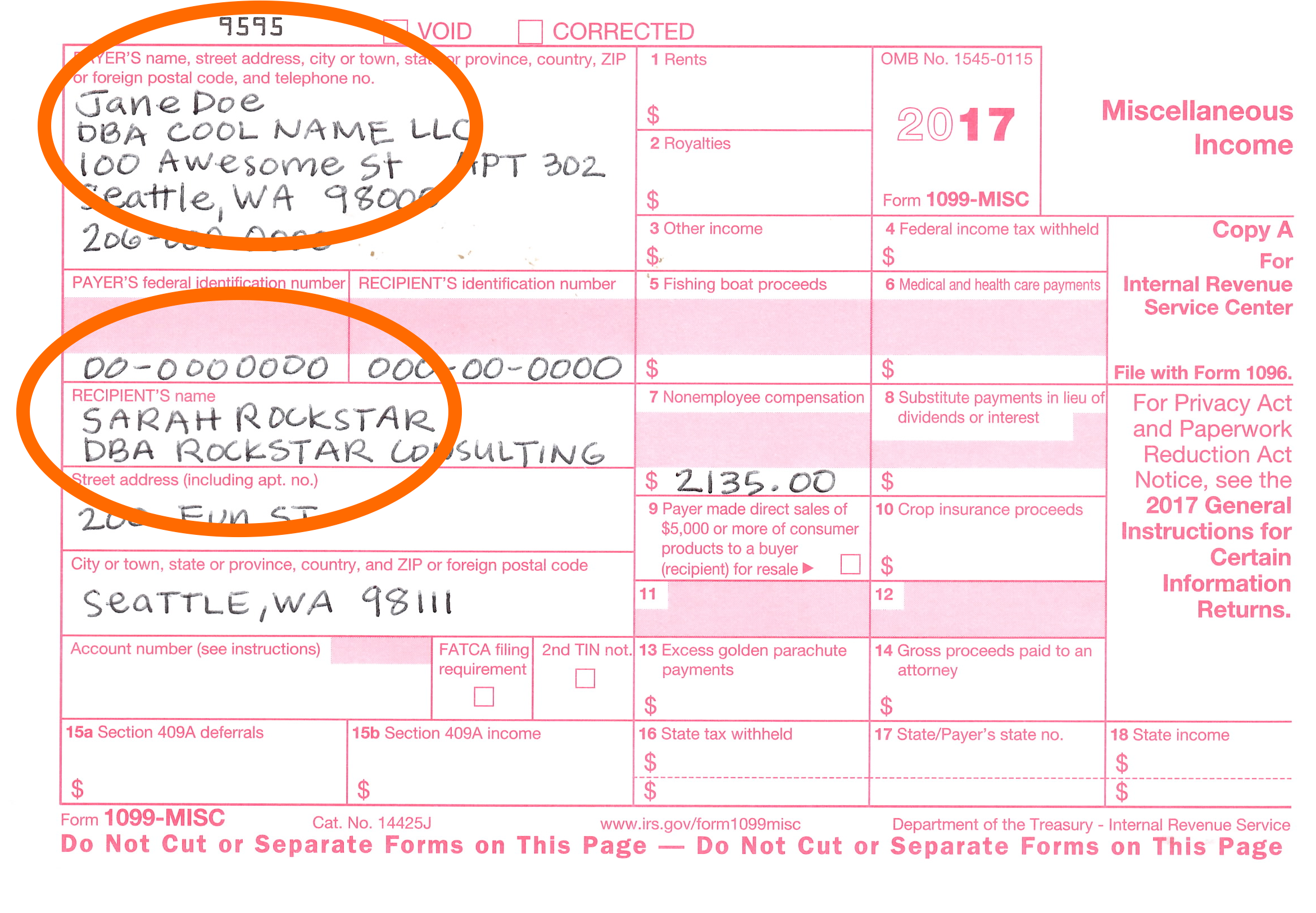

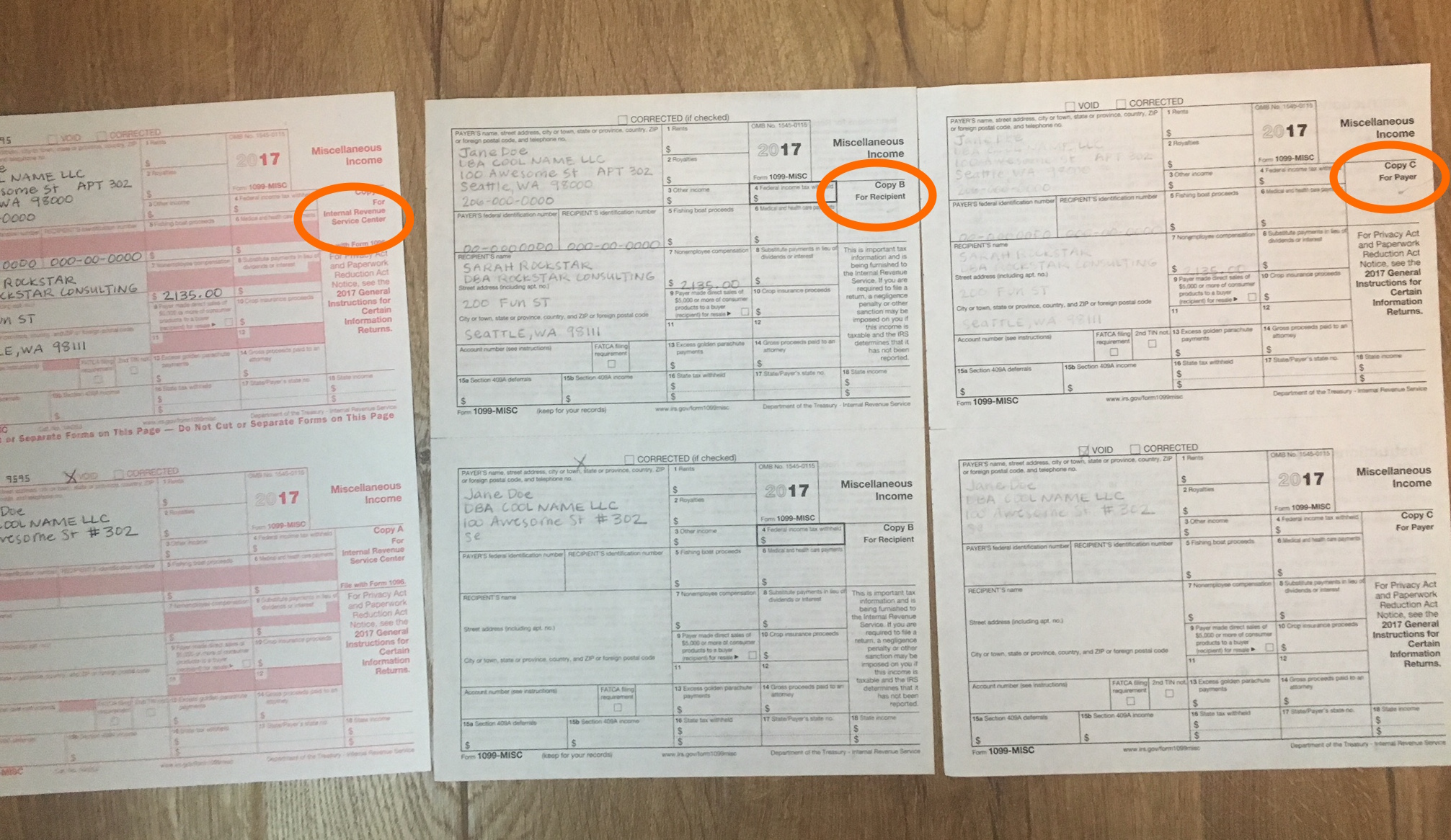

1099MISC Copy B–For the copy you'll send to the contractor, you can either fill out a physical copy of Form 1099MISC or print off an electronic version of Copy B from the IRS website Be sure to send the completed form to the contractor by January 31This year, the IRS is requiring those filers to use form 1099NEC instead of 1099MISC If you need to report nonemployee compensation for the tax year, you will need to use the 1099NEC form NOTE We are now taking orders for 21 tax forms to be shipped in August tax forms are no longer availableSample 1099NEC The 1099NEC is being introduced for tax year Previously, these amounts were reported on Box 7 of the 1099MISC To read a brief description of a box on the 1099NEC, move your mouse pointer over a box in the sample form

What Is The Account Number On A 1099 Misc Form Workful

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 9595 VOID CORRECTED3/29/21 · Those making payments to nonemployees must issue the newly introduced Form 1099NEC to nonemployees and independent contractors, rather than Form 1099MISC, but Form 1099MISC is still alive and well It now reports other sources of income, including the vaguesounding "Other Income" 6/9/18 · D Frank Date February 26, 21 Information reported on a 1099 Form is used to complete a person's 1040 Form as part of a federal tax return In the United States, corporations, small businesses and other employers use a variety of forms to record the income earned by employees and independent contractorsTypically, employees of a business in the US receive a

Form 1099 Misc Instructions

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

12/29/ · New Updates for calendar year The 1099NEC (nonemployee compensation) will replace most of the 1099MISC forms that are filed, but not all of them The IRS says that trades or businesses need to issue Form 1099NEC if the following conditions are met You make a payment to someone who is not your employee7// · Avoiding common Form 1099NEC mistakes can save your business time and money If you have further questions, we recommend seeking out a professional accountant, for whom you'll send a 1099NEC next year Starting tax season in 21, you may need to file Form 1099NEC Efile 1099NEC forms with eFile360 Sign up for a free account hereForm 1099MISC 12 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city, state, ZIP code, and telephone no

1099 Misc Form Fillable Printable Download Free Instructions

Understanding Your Tax Forms 16 1099 Misc Miscellaneous Income

Generally, the amount from Form 1099MISC Miscellaneous Income, Box 3 is reported as Other Income on Schedule 1 (Form 1040) Additional Income and Adjustments to Income, Line 8The amount reported in Box 3 may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or payments from a former employer10/21/ · Beginning in , the IRS has split the 1099 into two separate forms Form 1099NEC (for nonemployee compensation) and Form 1099MISC (for other miscellaneous service payments) Form 1099NEC Nonemployee compensation of $600 or more should be reported on Form 1099NEC · You don't have to worry about sending a 1099 to Global Stonework Megacorp Inc, because they're a corporation, not an independent contractor 1099 example for independent contractors Suppose you're a freelance graphic designer, and a local coffee shop called Whole Latte Love pays you $1,000 to design their new logo

Form 1099 Nec For Nonemployee Compensation H R Block

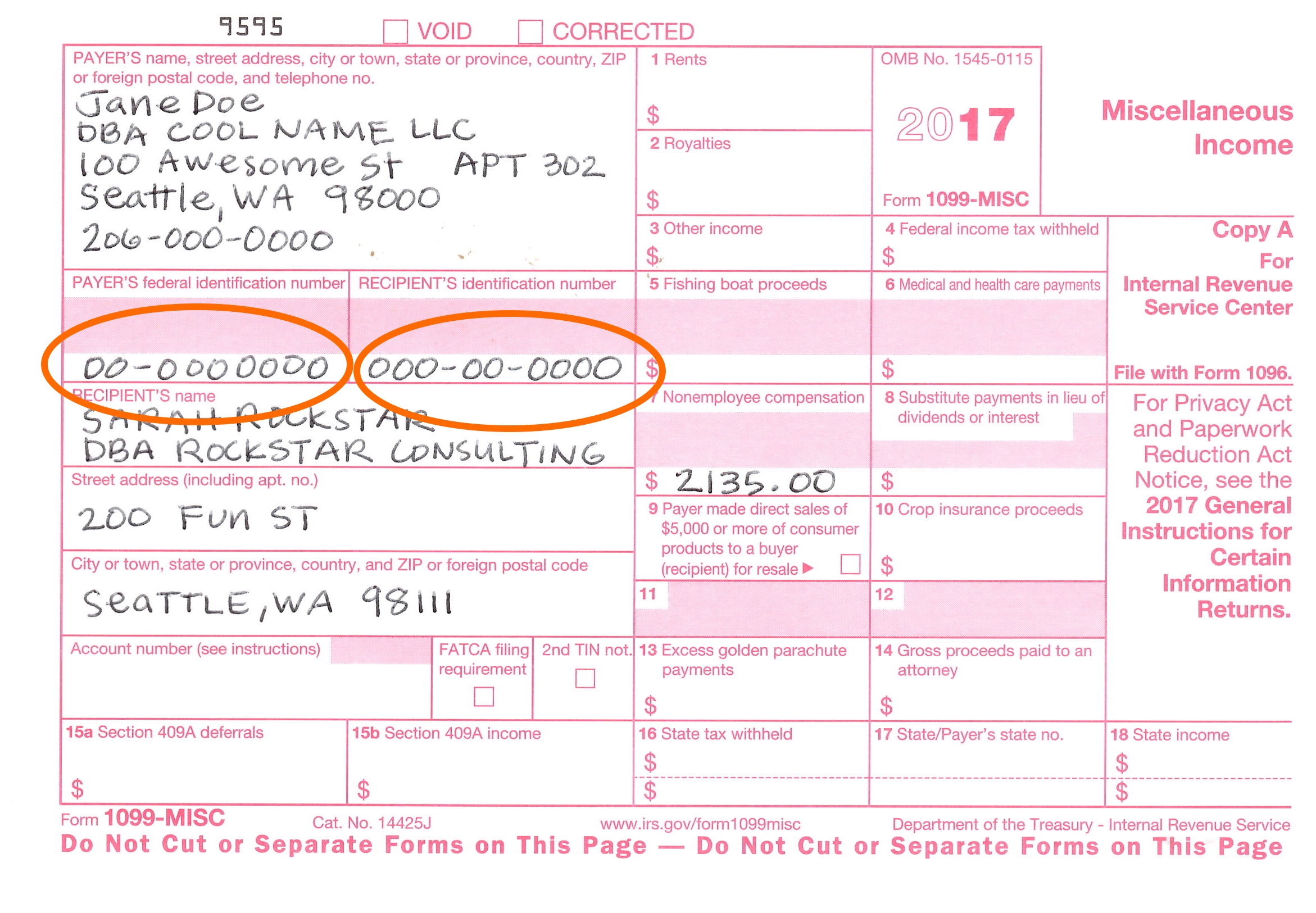

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

4/30/21 · Create Fillable & Printable Form 1099MISC online for tax year Fill, Generate & Download or print copies for free eFile with IRS for $149 per FormRevenue is reported on the Form 1099Miscellaneous and 1099NEC Income statements for the year in which the check was issued;Regardless of when the owner received the check In this example, the revenue would be reported on the form

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

New Irs Rules For 1099 Independent Contractors

11// · Form 1099MISC is still in use for the tax year and beyond, but it no longer includes nonemployee compensation It reports payments such as rents, prizes and awards, medical and health care payments, nonqualified deferred compensation, consumer goods for resale, and royalties —basically miscellaneous payments to anyone who isn't an independentIf you need to enter another 1099MISC, select Add Another 1099MISC to enter a new one Enter the information from your 1099MISCThis section provides a sample of the 1099MISC form, which you use to report miscellaneous income 1031 1099MISC Form Sample These are examples of 1099MISC forms for 19

Slopup5yyxohcm

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

The independent contractors need to report these payments on their tax returns as well For example, if you hire a website developer on a contract basis to develop a website for your business and paid $00 for their services, then you must report the $00 payment to the website developer on Form 1099MISCThe 1099MISC is used to report certain types of nonemployee income As of the tax year, the 1099MISC is now only used to report the following types of income worth at least $600Simply, you can complete your Online 1099 MISC Income Reporting Form Filing process within a few minutes by following our procedure File 1099 Miscellaneous Income Form Still, you are getting doubts on the IRS Tax Form 1099 MISC , then immediately contact our customer care number on 1

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

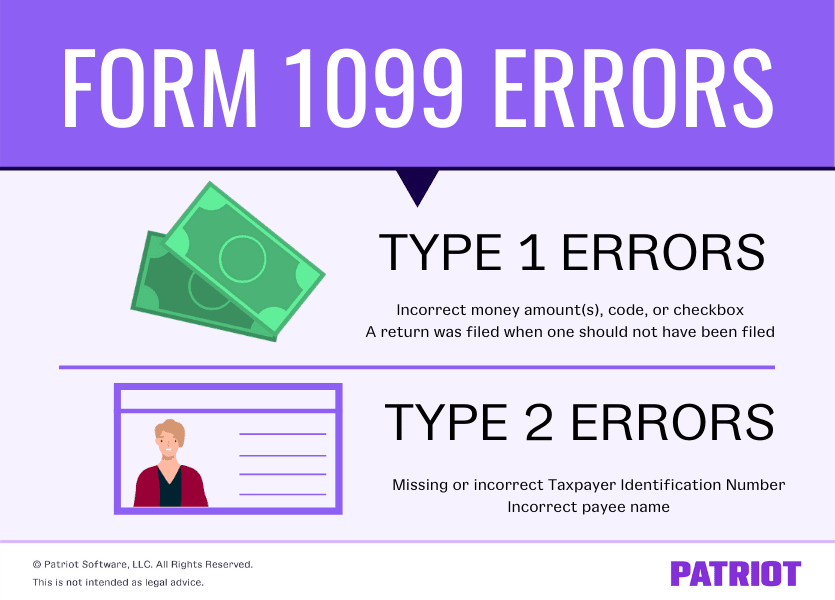

12/30/ · The 1099Misc listed royalties, rents, and other miscellaneous items, but its most common use was for payments to independent contractors Starting in , the IRS now requires payments to independent contractors are shown on a new form 1099NEC (nonemployee compensation) instead of the 1099MISC (miscellaneous)12/1/ · Learn how to avoid 1099 mistakes and how to correct a 1099 if you make one What you need to know about 1099 forms Forms 1099 are information returns that businesses use to report certain payments There are two types of 1099 forms Form 1099MISC and Form 1099NEC Between 19 – , businesses used Form 1099MISC for all 1099 reportingYou can face fines for not sending out your 1099 Forms by the deadline For 1099 filed up to 30 days late, you can face a $50 per 1099 fine For those filed more than 30 days late, it's $100 per 1099 If you don't file at all, it can be up to $260 per 1099 form

How Will 1099 Misc Reporting Be Different Carr Riggs Ingram

1099 Misc Form Fillable Printable Download Free Instructions

File IRS Form 1099 Misc Online In this way, you need to select the required category for your payment or income in the 1099 MISC Reporting Form and enter the amount in that category And, to complete your Online 1099 Misc Form Filing process, you have to fill the Official 1099 MISC Form with the payer and non–employee details They areSample Of Fillable 1099 Misc Form You can select a 1099 Information return after entering our site You can click the ok option to select the appropriate 1099 tax return If you have accurate information of the recipient, it's time to enter data on a 1099 Miscellaneous Form3/25/17 · What are the fines for missing the Form 1099 deadline?

Form 1099 Misc It S Your Yale

1099 Misc Form Fillable Printable Download Free Instructions

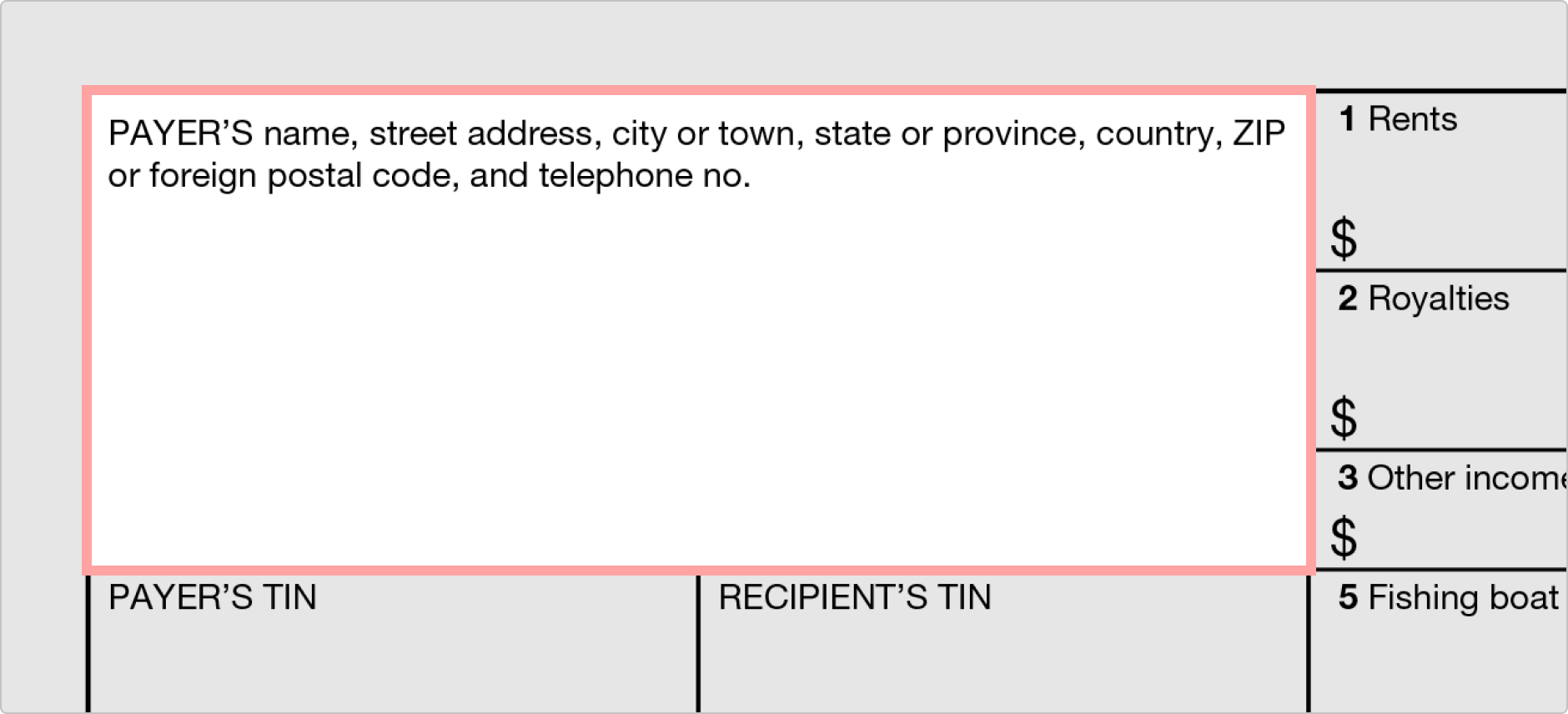

December MISCELLANEOUS INCOME & NONEMPLOYEE COMPENSATION FORMS 1099 The IRS wants to make sure that individuals and entities are reporting all of their income Therefore, they require a trade or business to complete a 1099 Form and submit a copy to the IRS and a copy to the recipient10/27/17 · How to Fill Out a 1099MISC Form As a small business owner or selfemployed individual, below are the steps to fill out a 1099MISC form Step One Enter your information in the 'payer' section Complete your personal details in the box in the topleft corner, including your full names, home address, contact number etc Step TwoForm 1099MISC, for Miscellaneous Income, is a tax form that businesses complete to report various payments made throughout the year One Form 1099MISC should be filed for each person or nonincorporated entity to whom the business has paid at least $10 in royalties or at least $600 for items such as rent and medical or health care payments

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

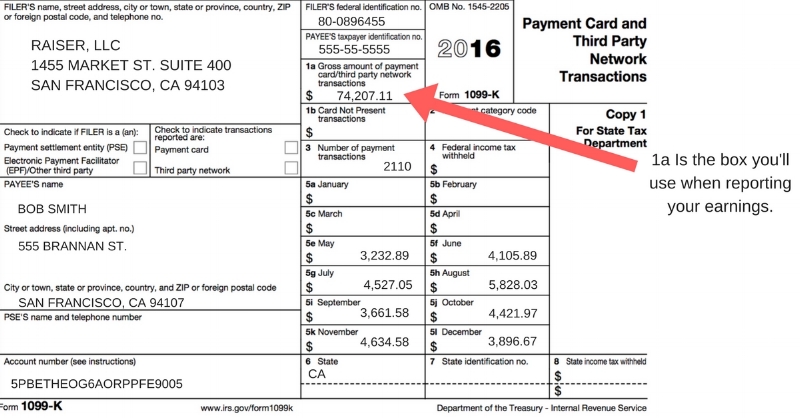

1/6/ · For example, Tesla reached the 0,000 vehicle milestone in July 18 As a result, the tax credit reduced to $3,750 for vehicles purchased between January 1, 19, and June 30, 19 For vehicles purchased between July 1, 19, and December 31, 19, it goes to and $1,875 Starting in , Tesla buyers will no longer receive a federal tax credit2/18/21 · A very active Airbnb listing for which hosts have more than 0 guest bookings per year would be an example of side income that would lead to issuance of a 1099K Ridesharing drivers will also receive a Form 1099K for gross ride receipts accrued during the tax year, in addition to a Form 1099MISC Form 1099LTC Reports longterm1099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plus Rents and Royalties 3 ATTORNEY 1099MISC Box 3 Other Income plus Attorney & Medical Payments Perfect for attorneys 4 1099

1099 Nec Software Software To Create Print And E File Form 1099 Nec

1099 Misc Form Fillable Printable Download Free Instructions

A PDF file for 1099MISC Copy B is generated that you can send to the vendors Also, a PDF preprinted form, with the financial transaction data, is generated You can print this data on a preprinted Copy A form and submit to the tax authorities The system generates a TEXT file that can be submitted to the government authorities1/22/21 · Next you need to figure out which 1099 tax form you need 1099NEC vs 1099K If you have reported any independent contractor income in the past, you are probably familiar with the Form 1099MISC Income from the tax year is going to be filed on Form 1099NEC, which is replacing the 1099MISC from last year

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

1099 Nec And 1099 Misc Changes And Requirements For Property Management

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

How To Fill Out Form 1099 Misc Youtube

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Misc Form Fillable Printable Download Free Instructions

How To Fill Out And Print 1099 Nec Forms

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Irs Form 1099 Reporting For Small Business Owners In

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Ready For The 1099 Nec

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

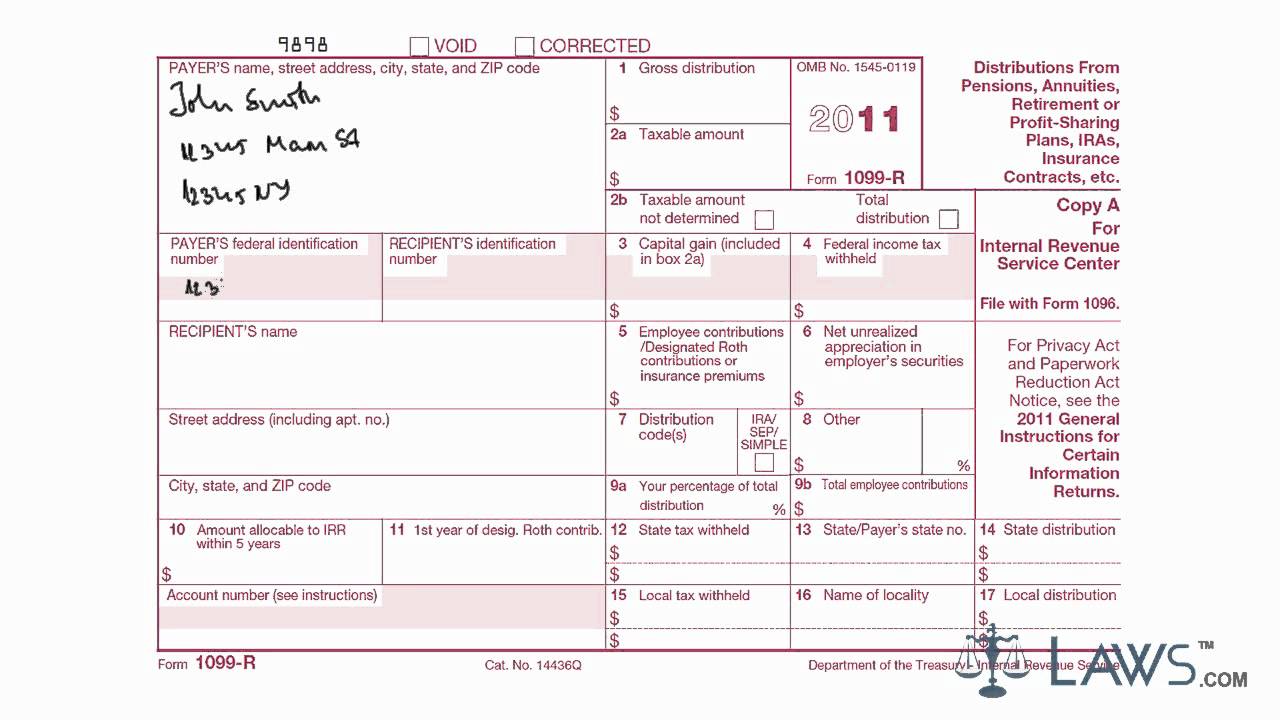

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 Misc Software Software To Create Print And E File Form 1099 Misc

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

Form 1099 Misc Instructions Line By Line 1099 Misc Instructions Explained

How To Fill Out And Print 1099 Nec Forms

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Irs 1099 Misc Form Pdffiller

How To File 1099 Misc For Independent Contractor

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

1099 Misc And 1096 Template 1099misctemplate Com 1099misctemplate Com

What Are Irs 1099 Forms

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

How To File 1099 Misc For Independent Contractor

Form 1099 Misc Instructions And Tax Reporting Guide

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

What Are Irs 1099 Forms

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

The New 1099 Nec

All You Need To Know About The 1099 Form 21

1099 K Tax Basics

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Understanding 1099 Form Samples

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Sample 1099 Misc Forms Printed Ezw2 Software

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

New Form 1099 Reporting Requirements For Atkg Llp

1099 Misc Form Fillable Printable Download Free Instructions

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About Form 1099

It S Irs 1099 Time Beware New Gig Form 1099 Nec

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

1099 Misc Form Fillable Printable Download Free Instructions

Your Ultimate Guide To 1099s

1099 Misc Form Fillable Printable Download Free Instructions

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Misc It S Your Yale

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

How To Fill Out And Print 1099 Nec Forms

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Misc Public Documents 1099 Pro Wiki

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

New Form 1099 Nec Sek

The 1099 Misc And Home Health Innovative Financial Solutions For Home Health

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

No comments:

Post a Comment